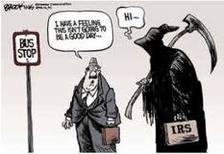

Internet Tax RUMORS!

Here are some rumors, innuendos and general gossip about changes to the tax system that will not make you a happy camper. Some are near true while others are really, really false. We'll try to cover what rumors that we hear, but if we miss some, let us know and we'll help find the answer for you.

Personal firearms must be listed on your tax return

the rumor

Senate Bill SB-2099 will require us to put on our 2009 1040 federal tax form all guns that you have or own. It may require fingerprints and a tax of $50 per gun.

This bill was introduced on Feb. 24. This bill will become public knowledge after it is voted into law. This is an amendment to the Internal Revenue Act of 1986. This means that the Finance Committee can pass this without the Senate voting on it at all. The full text of the proposed amendment is on the U.S. Senate homepage, http://www.senate.gov/ You can find the bill by doing a search by the bill number, SB-2099. |

the truth

The pending Congressional bill requiring gun owners to list their guns on federal income tax is both outdated and contains a good deal of misinformation. The referenced bill, “SB 2099” (the Handgun Safety and Registration Act) is not currently before Congress; it was introduced to the Senate back in February 2000 (not 2009), and it was referred to the Committee on Finance, where it languished without ever coming to a vote.That the intent of this bill was to affect nationwide registration of handguns is unmistakable.

However, It had no provisions for requiring handgun owners to list their guns on federal income tax returns. I know a lot of clients that will become liars if this were to be enacted! |

You'll pay a 3% sales tax on home sales

the rumor

Here's the email rumor:

Did you know that if you sell your house after 2012 you will pay a 3.8% sales tax on it? Under the new health care bill - did you know that all real estate transactions will be subject to a 3.8% Sales Tax? If you sell your $400,000 home, there will be a $15,200 tax. |

the truth

If you Google this rumor, you'll find that although the email is generally, sort-of, not-so-much possibly, mainly false.

However, on it's face, the tax will be implemented but with certain provisions. However, the 'fact checkers" will dismiss this tax as just a minor inconvenience to the "rich". One of the provisions in the health care act (Patient Protection Affordable Care Act PPACA) is a new 3.8% MEDICARE tax on net INVESTMENT income starting in 2013. However, the tax is imposed on the lesser NET income or the excess of modified adjusted gross income (AGI) over a "threshold amount" which is generally pegged at $250k for married and $125k for non-married. If you make less that those amounts, you are safe - at least for now. The tax is not a traditional sales tax; it's a tax that will go to the Feds as a Medicare payment. More importantly, the tax is not just for home sales; it's for all investment income like capital gains, interest, dividends, annuities, royalties, rental income, etc. Here's a good example regarding a sale of a personal home: a married couple with income over $250k sells their home and make a 750K profit on the sale of their residence. They would pay a 3.8% tax on $250k (the 750k profit minus the sale of home exemption of 500k). Every explanation that I've found of this tax increase rejects that "normal" Americans will be impacted. A tax is a tax and I refuse to segment society as others do. The threshold amount of 250k or 125k for non-joint filers is an artificial target. Apparently if you earn over those amounts, you are rich and should be subject to increased taxation. If you're happy with that logic, wait for that threshold to reach your income. |

Eric will be running for President in 2014

the rumorHeard around the water cooler is that Eric will be throwing his hat into the 2014 Presidential campaign

|

the truthThe truth is - first, I don't want a pay cut and second, this is a test to see if anyone is really reading this. Besides, beer and cigars are of a higher calling for me.

Oh, and I don't like hanging around with a bunch of jerks. |